This post contains affiliate links, which means we may receive a commission if you click a link and purchase something that we have recommended at no extra cost to you. Recommended products and services are based on my positive experience with them. Please check out our full affiliate disclosure

This post is all about how to get out of credit card debt fast.

Believe me, I couldn’t get out of credit card debt fast enough once I made the decision to stop spending and start saving. I didn’t even really know what had gotten me into the situation but somehow I knew that this way of living life wouldn’t be sustainable.

My one and only thought was: how to get out of credit car debt fast?

In a matter of months with a lot of dedication and a strong will, I started managing my money and paying off those credit card debts.

You might find yourself exactly where I was, asking yourself how to get out of credit card debt fast, because you just want a solution! Let this post help you pay of your credit card debt as fast as possible, so you can move onto building your wealth through saving and investing.

However, before we get to the part where we explain to you how to get out of credit card debt fast, let’s first examine a few questions that shine more light on credit cards in general.

Quick Navigation

What exactly is credit card debt?

Before you find out how to get out of credit card debt fast, you need to know first what credit card debt is.

Credit card debt is probably THE worst kind of debt one can carry around. In fact, credit card debt is the number one consumer debt that’s plaguing millions of people living in North America today.

Credit card debt is a type of debt that is usually unsecured and revolving, meaning that the borrower can continuously accumulate more debt, pay it off if when one decides to or not, and continue the cycle to purchase goods and services.

Credit card debt – amongst all the kind of debts out there in our world, is so bad because of the high interest rates, and the fact that almost anyone and everyone can apply and become a credit card holder.

Because credit cards are widely available and easy to obtain, they’re usage is very tempting. The rectangular shaped plastic card has become the means to pay for everything nowadays, especially with the ease of use in stores by quickly tapping or swiping or when making a purchase online.

Credit card debt can make you have sleepless nights as every new month you are not paying the full amount off will accumulate more and more interest.

This is why you would want to pay off this kind of debt first before moving on to your other forms of debt.

Why do people find themselves in credit card debt

Most people nowadays find themselves in credit card debt. There isn’t just one particular reason why a person has credit card debt. In fact it can have many reasons why people find themselves in credit card debt.

However, what these people have in common among other things are:

- They do not have a budget in place

- They do not have the money available to spend

- They are in way over their head and don’t realize it

- They do not understand that they are losing money on paying interest each month by not paying off their amounts in full

What kind of people find themselves in credit card debt

There isn’t one particular person that finds themselves in credit card debt. In fact, it can be high earners as well as low earners who accumulate and carry high amounts of credit card debt.

Especially though, when people start earning more, they are going to increase their lifestyle which could contribute to an increase in their credit card debt.

So it isn’t really a particular type of person that find themselves in this situation.

It can really be anyone.

What is the fastest way to get out of credit card debt?

The fastest way to pay off credit card debt is to immediately:

- Stop using your credit cards. You could cut up your credit cards if you are really bad (Dave Ramsey Style). If you believe and trust yourself to get out of debts and in future be responsible with credit cards, then do not cut them up.

- Look at each credit card statement. Analyze your spending, use different highlighters to categorize your expenses. Go back at least three months in your credit card statement history.

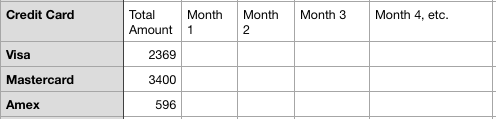

- Create a spreadsheet. You can create a spreadsheet in Excel like this one:

What are three ways to pay the credit cards off fast?

Decide how to pay off your credit cards.

There are a few ways to do this properly and you can start to pay them off that has the highest interest, or tackle the one with the lowest amount owing (Dave Ramsey Style). You could also pay off the one with the highest amount first.

How long does it take to get out of credit card debt

The time it takes to pay off your cards depends on the amounts owing on them. The greater the total amount, the longer it takes. You should use this calculator to find out how long it will take you to pay your cards off completely. This is the one I used when I started paying off my credit cards.

Of course you can try and increase your debt payments but you will only be able to do so much. You will most likely have to get another job – find more income to get to your goal faster.

One way to do this is to start making extra money.

READ: 10 SIDE HUSTLES THAT MAKE SOME SERIOUS MONEY IN ADDITION TO YOUR DAY JOB

How do I pay off credit card debt fast when I live paycheck to paycheck?

When payday comes along, subtract your living expenses / fixed costs first (i.e. rent, car, bills, grocery, etc) from your salary. Then, throw any and all leftover money at your credit cards. Do it in chunks ($200, $300) if you can and then make minimum payments on the other cards so you don’t get charged interest and owe even more. It will be slow at first, but then it will go faster.

How can I pay off my credit card debt on a low income

When you are on a low income, paying off your credit cards can become somewhat challenging. You can try to cut down your expenses here and there but it might not be enough.

You may only able to throw a little bit each month at your debts. This is exactly where you have to start making more money. You might be able to get a raise at your work but if that doesn’t work, really you need to find a way to be making additional income.

You need to find a side hustle that brings in more money.

READ: HOW TO START A BLOG WITH BLUEHOST

Should I Cancel My Cards Once They Are Paid Off

If neither of the cards give you much back in rewards. Apply for a new card, that does give you better rewards, once accepted, close all others that now have become obsolete.

Go on a complete no spend until your cards are fully paid off. Cancel all ridiculous memberships and subscriptions immediately. Only use cash from now on to make purchases.

You can use Paypal (attach your debit card account to your Paypal), or use a one-time VISA card. Many debit cards nowadays are also VISA debit cards. This way your purchase goes straight from your account and you’ll be done with it, as opposed to having a balance on your credit card again.

There are many ways to manage your money but using a credit card doesn’t really help. You need to find a new method to manage your money.

Have you ever tried cash envelopes? The cash envelope method has helped many people manage their money better.

READ: WHAT IS THE CASH ENVELOPE METHOD AND HOW DOES IT WORK

Take Preventative Measures

Once paid off, keep only one OR if you must, two credit cards. If you have more than 2 cards, this will be dangerous and could potentially lure you into spending again. Keep one OR two if you must, which give you the most benefits, as in travel points, cash back OR any other rewards that you fancy.

Make sure you limit yourself. Do not ever increase your credit limit no matter how many times the credit cards institute welcomes you to do so.

In the case that you cancel your cards, please make sure you request and receive a confirmation that the credit cards are indeed closed for good.

Always make sure you SAVE FIRST, then spend it. In future, pre-pay your credit card, if you are planning on making a big purchase (save the money for the purchase first, then go spend and finally transfer the amount you saved immediately to the credit card).

CONCLUSION: HOW TO GET OUT OF CREDIT CARD DEBT FAST

Start the challenge today. It takes a lot of commitment to start paying off your credit card debt fast. But freeing yourself to become more responsible and be in control of your cash flow, spending and how you handle credit cards once you’ve moved past the debts is really a tremendous feeling. You will no longer have sleepless nights or be stressed. You will take control of the money situation and feel empowered to be making these changes in your life.

This post is all about how to get out of credit card debt fast.

Image Credits:

“Credit Cards, Wallet” – Unsplash