This post contains affiliate links, which means we may receive a commission if you click a link and purchase something that we have recommended at no extra cost to you. Recommended products and services are based on my positive experience with them. Please check out our full affiliate disclosure

This post is all about how to stay motivated on your debt-free journey.

Quick Navigation

Why Is The Debt-Free Journey So Hard?

A question most people ask themselves when they sit in front of a huge mountain of debt. Be it they are starting to pay off two cars, start chipping at their insanely huge mortage or just simply start tackling their five credit cards.

Your debt-free journey is probably one of the toughest things you will be going through.

If you’re in debt now and want to get out, and you’ve even made progress already, you may agree that often times, it becomes hard to stay on track….to stay motivated.

There are days when you just want to throw it all out of the window, am I right?! Paying off debt is not easy at all.

The debt-free journey is so hard because it is easy to just quit. It is easy to bite into your emergency fund before you’ve even build it up to 3 to 6 months worth of expenses.

It’s hard because it’s insanely difficult to stick to your committment. Not only that but especially when emergencies happen and you drain your emergency fund by 50%, what’s not to say that you’re just going to surrender?

Even if you’ve already paid of a chunk of debt, and say you’ve created a small emergency fund for yourself, it’s super easy to start spending some of that money again.

So the big questions is, “how do you stay motivated on your debt-free journey?”

What Are Ways To Stay Motivated On Your Debt-Free Journey?

Many people start their debt-free journey with great motivation and euphorism. These feelings don’t usually last all throughout your financial journey.

A majority of individuals lose motivation at some point or another during their financial journey and can we blame these people? No!

Let’s be honest, paying off big amounts of debt usually takes years and years of sacrifice, dedication and committment. That is not an easy job to do by any means!

So how can you stay as exhilarated as you were, when you first started your financial plan and continue to motivate yourself?

1. Identify Your WHY

The most important reason that justifies all the sacrifice, dedication and committment to pay off debt and stay motivated during your financial journey is identifying your WHY.

WHY do you want to stop paying for things on credit card? WHY do you want to start paying off debt? If you know your WHY, keep reminding yourself! If you haven’t figured out your WHY yet, do it right after reading this blog post.

Your WHY is one of the most important factors when it comes to making the decision to start paying off your debt.

2. Set SMART Goals For Yourself

There is no such thing as trying to achieve something without setting achievable goals. This means that you cannot set goals that are out of your reach. For example, when you make the decision to pay off all of your credit cards in 1 year, you will need to make sure you set yourself achievable goals. Maybe all of the credit card debt equals $80,000 dollars but you bring home only $40,000 dollars. Well, there’s a possibility you wouldn’t hit that goal.

So it’s always important to set yourself achievable goals.

3. Don’t Be Too Impatient

Being impatient can drive you nuts, literally. One thing for sure is, that when you become impatient during your debt-free journey, you are likely to quit.

So in order not to quit, stop being impatient. Relax, breathe and just do the work to get to where you want to be. We all know that paying off debt is a marathon. Remember, Dave Ramsey always says, “slow and steady wins the race”.

We all know that nothing kills a process more than impatience.

4. Focus On Your Milestones

Stay motivated by focusing on your milestones. As you move forward on your debt-free journey, little focus should be spent on the “mistakes”, “the past”, “how long it takes to get to the next step”, and “how big this hill is you are trying to climb”. Focus on the steps forward and milestones you have reached on your journey. Every little step is a big milestone, if it’s toward getting that amount of debt paid off. Whether you contribute $25 dollars or make a chunk payment of $2500.

Every small step forward is a milestone which you should continue to focus on.

5. Share Your Debt-Free Journey

Another way to stay motivated is through accountability, and most individuals can do this by sharing their journey with others in the world. Maybe you could start a blog and start your diary or journal to share your story along the way. Who knows, you might even inspire others to start paying off their debt as well.

You never know what positive impact sharing your debt-free journey can have on somebody else who is in a similar position as you.

6. Give Yourself A Little Grace

You’ve come far and when you find yourself stuck, think about how far you’ve come. It’s easy. Certain phases during your debt-payoff journey will seem as though they go on forever. But these phases also pass.

At least try to give yourself grace.

8. Use Debt-Payoff Visuals

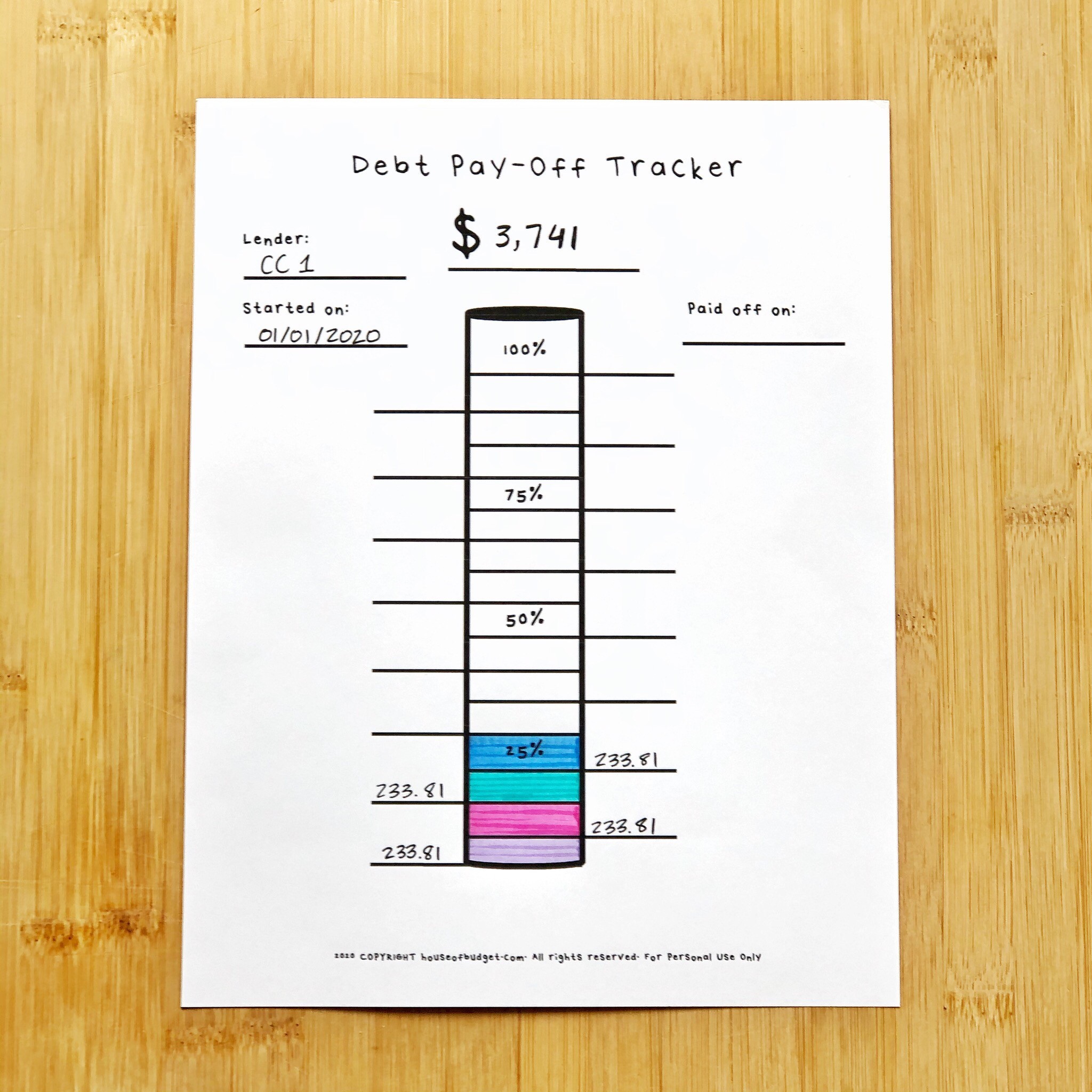

I don’t know about you but I am a very visual person. I have always been a visual learner and looking at something that shows my progress is what keeps me going.

I like to see progress right in front of me, not just on my Excel spreadsheets or bank accounts. I love to color in my progress and always made sure to make my debt-free journey fun because there were a lot of sad times.

The main reason why I stayed motivated was because I constantly visualized debt being paid off. There are an abundance of ways to try and keep yourself motivated but there’s one in particular that helped me every step of the way: debt-pay off trackers! There’s something about seeing right in front of you where you are going during your debt-free journey and coloring in your successes along the way. Coloring in the amount of money every time you make a debt payment is one of the most satisfying things I find.

You will feel more focused, committed but above all, really motivated to continue to want to fill in those trackers until you’ve reached your goal.

9. Get Your Family/Partner Involved

Not a lot of people like to talk about their money failures. As a matter of fact, many individuals keep their money problems a secret from their family and partners. When you are trying to pay off debt, it is always good idea to at least think about getting your family involved. Be it your partner or parents, or even your children (if they are old enough to understand the topic!). When you get your family involved, it becomes something that everyone can understand and respect.

You and your family can work towards a common financial goal.

10. Reward Yourself With SMALL Rewards

Small rewards go a long way! Now, not many people will agree with me on this point but I do believe that rewarding yourself is inherently important during your debt-free journey to keep yourself motivated and to continue to go strong. By small rewards, I am talking about things that don’t cost much. It can be a sundae ice cream from McD’s or something that you need, value and appreciate and buy from a store that makes you happy. Please be mindful when you are rewarding yourself along the way and that you do not fall back.

We are talking about SMALL rewards, which means anything under 5-10 bucks in cash, NOT using credit!

Final Note

It’s not easy to stay motivated on your debt-free journey. It can feel as if you are climbing a mountain and never reaching the top. The goals can seem far, far away and sometimes we just feel like giving up. However, as you can see, there are in fact a lot of ways how you can still manage to stay motivated during your debt pay off journey. The biggest thing to understand is that you can give yourself grace, you can reward yourself in small ways to keep your motivation going. Most importantly, please don’t stop – because it does get better and you need to just stick to it. It’s a long journey but once you’ve come out on the other side, just imagine what that will feel like being debt-free? Can you imagine? Just keep going!

This post is all about how to stay motivated on your debt-free journey.