This post contains affiliate links, which means we may receive a commission if you click a link and purchase something that we have recommended at no extra cost to you. Recommended products and services are based on my positive experience with them. Please check out our full affiliate disclosure

This post is about 5 money saving tips you can start implementing today.

Quick Navigation

Here Are The Tips You Can Implement Starting Today

1. Check Your Bank Account Daily

Whether you use your bank’s app to do your “check-in”or the good old browser, checking your bank account daily is a must. I don’t know about you but for me the saying “out of sight, out of mind” also applies to me, my money and budgeting journey. One thing is for sure that if you don’t see your bank account daily, transactions occurring in your chequing and savings accounts and activities on your credit card (if you are a credit card user), it is easy to quickly loose track and fall off the bandwagon with your budget.

There really shouldn’t be one day that you are skipping the check-in with your bank account to see what has changed with your money. In all honesty, you can track your progress or regress. Of course we want to progress and if you see your transactions every day and your balance, you’re better off with your budgeting/money journey.

Checking in every day with your bank account reminds you of your spending but also you are able to see your progress. Doing good with money is addicting and the more you will save, the more fun it all becomes to check your account every day and seeing your net worth grow. Doing this actvity once a day will keep you motivated to continue your budgeting journey!

2. Track Your Expenses in Depth once a Week

There should be one day a week, where you dedicte a few moments to go through all of your transactions. You can, again, do this from your app or online from your computer. You should look at all of the expenses in more detail and write them down or log them in Excel. I prefer to write them down because there is something that makes it seem more real when I use pen and paper. It’s like my brain gets it. It sinks in, especially if there were a lot of expenses, I just realize I need to slow it down. However, if you are dependent on computers, go ahead and use Excel and log it. That’s totally fine.

Pick a day that suits you the most. Maybe it’s on a Saturday night when the kids are in bed and you have some quiet time. Or, maybe you want to do it on a Sunday morning, bright and early before the Sun’s out. Whichever day you pick, pick a time slot that enables you to have a few moments to yourself and your budget. You will want to look at your expenses and ever so often add them up during the month to see where you are at so that there won’t be any crazy surprises at the end of the month when you are closing out your budget. I started doing this in January and it gives me a better feeling knowing where I am with my numbers. Since I have stopped using cash envelopes for the time being, I am using my credit card for all purchases for which I already have the cash to pay it off right away. I decided to use my cashback credit card because it gives me too many perks to not use it.

3. Have Visuals That Support Your Goals

Visuals, such as debt-pay off charts or progress charts are an awesome way to keep your motivation going. Yes, budgeting can be extremely tiring and actually quite demotivating at times. Especially if you find yourself still paying off debt or trying to reach a goal (ie. down payment for a house is a big one!) , having visuals in your home that keep reminding you of your journey is essential. It’s keeping you on track and coloring in your progress is a great way to keep yourself and your family motivated. Of course it also helps you celebrate your milestones. Yes, those milestones should be celebrated, no matter how small or big they are.

4. Keep Your Receipts In Eye-Sight

Keeping your receipts that you’ve gathered throughout the week in eye sight is another way to visually remind yourself to not go overboard with spending. I do not like seeing receipts pile up on my desk but on the contrary I love that I somewhat can measure my spending by seeing exactly how the stack of receipt keeps piling up. You want to make sure that you don’t just stuff your receipts somewhere. Keep them on your desk, in a bowl, in a place where you can see the receipts piling up. Then, every couple of days look at all of the receipts and start sorting them into the different purchase categories (ie. Eating Out, Groceries, Entertainment, Household, etc.). Then, by the time you are doing your “once-a-week-in-depth” tracking of expenses and your budget, you have already all of the receipts ready to go through and can quickly analyse your spending that you’ve done over the week. It’s that easy!

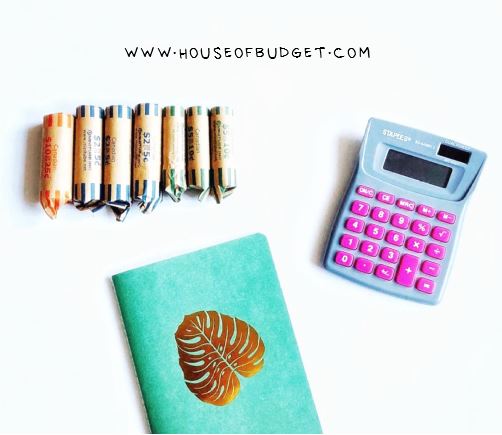

5. Save Your Small Change in a Money Tin

Small change can be a bit of a nuisance if it’s flying around everywhere. We all know this, small change can be found anywhere from your cup holders in your car to in between your couch cushions. It’s just something about small change that seems to annoy a great deal out of people, myself included. So I found the solution: a money tin.

Every quarter or dime that’s either on the kitchen island, found in a purse or suitcase now gets put into the money tin. You would not believe how quickly small change can add up in a tin. I mean, mine is getting quite heavy already and I only started recently. Having your coins all in one place signifies to the Universe that you appreciate money, no matter how small of a change you have. You care about the penny that’s been in your jacket! This brings good vibrations your way and should open the possibilites of abundance.

A money tin is a great way to stash away your coins that accumulate during the year and by the end of the year, it’s really exciting to open the money tin and actually see how much you’ve saved. It’s a great feeling. Once you’e added all your coins and wrapped them neatly it’s time to deposit the money to your checking account. You get to allocate it towards your short-term or long-term saving goals or pay off debt. (All banks are different in the way how they want you to deposit your coins). If you are thinking of getting a money tin, try to get one that cannot be opened. This way, the temptation of reaching for those coins is eliminated right from the start.

Final Note

Minor money tips such as checking your bank account daily to keep tabs on what’s going in with your money can make a huge difference when it comes to your overall money situation. You need to track your expenses at least once a week in detail to see what your progress is. By using visuals such as debt-free charts or making your own for your individual goals keeps you motivated along your money journey, be it to pay off debt or save diligently for retirement or a property. You want to make sure that you keep your receipts always close by. Don’t just put them into an envelope. As you see your receipts pile up you know your spending has increased so keeping them in eye sight will help you slow down your spending. Finally, save all of your money! This includes pennies, dimes and nickels. Appreciate your coins and keep them all in one location with a money tin. You will see how quickly your money adds up in a money tin and before you know it, you are one step closer to your savings goal or paying off debt!

This post is about 5 money saving tips you can start implementing today.